Many people with missing teeth think about getting dental implants in Walnut Creek to improve their oral and overall health. But these implants can be pricey, and the big question always is: will your insurance help with the cost? This article breaks down insurance basics so you can get the answers you need.

Understanding Dental Insurance Coverage

First, it’s important to understand that dental insurance plans vary widely in terms of coverage. Most dental insurance policies categorize dental procedures into three primary groups: preventive, basic, and major. Preventive services like regular check-ups and cleanings are typically covered at a higher rate, while basic and major services receive lesser coverage.

Dental implants usually fall into the category of major dental procedures, which means that they may receive little to no coverage from your insurance plan. The reason for this it’s that dental implants are often considered elective or cosmetic procedures, even though they can have significant health benefits.

It’s essential to be prepared for the possibility that your insurance plan may not provide coverage for dental implants, and you may need to explore alternative financing options

Factors Influencing Dental Implant Insurance Coverage

Reason for Implants

Insurance coverage for dental implants often depends on the reason for the procedure. If your implants are necessary to replace missing teeth due to an accident, injury, or a medical condition, your insurance plan may be more likely to provide coverage. On the other hand, if you seek dental implants for purely cosmetic reasons, the chances of insurance covering the procedure decrease.

Insurance Plan

Before undergoing dental implant treatment, it’s important to be well-informed about your insurance coverage. Here are some essential questions to ask your insurance company to avoid unexpected surprises and make the most of your coverage:

- Does your plan cover implants? Ensure that dental implants are included in your policy’s coverage. Some policies may not cover elective or cosmetic procedures, which could impact your coverage for dental implants.

- What percentage of the procedure does the policy cover? Understand the extent to which your insurance plan will contribute to the cost of dental implants. The coverage percentage can vary significantly among different insurance plans.

- What is my annual maximum out-of-pocket cost? Many dental insurance plans have an annual maximum out-of-pocket cost, which is the most you’ll have to pay in a given year for covered dental services. Knowing this limit can help you plan your budget effectively.

- Do I need a referral before receiving dental implants? Some insurance plans may require a referral from a general dentist or another healthcare professional before you can proceed with dental implants in Walnut Creek. Ensure you follow any necessary referral procedures to comply with your policy’s requirements.

Alternative Treatment Options

Your insurance provider may recommend alternative treatment options, such as bridges or dentures, that are less costly than dental implants. Your coverage may be better for these alternatives.

In cases where dental implants are not fully covered by insurance, patients often explore other options for financing their treatment. This might include dental savings plans, health savings accounts (HSAs) or flexible spending accounts (FSAs), or financing arrangements with the dental clinic.

Interested in Getting Dental Implants in Walnut Creek?

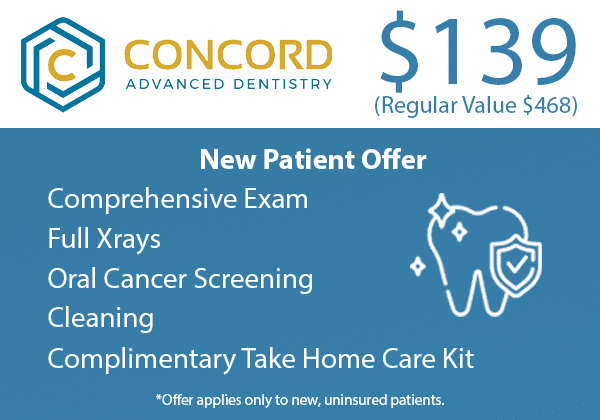

At Concord Advanced Dentistry, we’re here to support you on your journey to a better smile. Our experienced team can provide guidance on insurance matters, discuss treatment options, and help you clear up your doubts about dental implants. Contact us today to schedule a consultation and let us help you restore your oral health and confidence.